AI x Crypto: The Case for Protocol-Specific Intelligence

Most AI crypto projects add complexity without adding value. This research surveys the landscape and argues that effective AI agents require protocol-specific training, not generic prediction models.

The intersection of AI and blockchain based financial systems has become an increasingly active area of research and development. Crypto markets present a uniquely rich environment for AI driven systems: they are fully digital, transparent by design, continuously operating, and governed by explicit protocol rules rather than discretionary human intervention. At the same time, DeFi protocols are complex, composable systems whose behavior emerges from the interaction of smart contracts, market participants, and incentive mechanisms.

AI offers tools to manage this complexity, from information extraction and decision making to autonomous execution. Conversely, crypto native infrastructure provides new primitives for AI deployment, such as trust minimized execution, programmable incentives, and onchain ownership of digital assets, including models themselves. The convergence of these two fields has given rise to a growing ecosystem of AI powered crypto applications, ranging from user facing tools to protocol level infrastructure.

This article surveys AI applications in crypto and presents a thesis: effective agent design requires protocol-specific strategic reasoning, not generic prediction.

Current AI Crypto Projects: A Category-Level Assessment

Current crypto projects that integrate artificial intelligence can be classified into a set of macro-categories, according to where intelligence is applied within the system stack and what role AI plays in user interaction, decision-making, or infrastructure provisioning.

A note on methodology: while dozens of projects claim AI-crypto integration across various subcategories, our analysis of the space shows most of this is just buzzwords. This doesn't come as a surprise given the current AI fundraising mania and declining crypto appetite. Still, our sample skews toward well-known projects or those backed by top-tier sector funds, which, if anything, reinforces our argument. If the best-funded projects show these patterns, the long tail is unlikely to be any better.

AI for Onchain UX: Natural Language to Protocol Execution

A first category focuses on improving user experience and accessibility by abstracting protocol complexity.

These systems leverage AI to translate natural language intents into structured protocol-level actions, enabling users to interact directly with onchain systems without requiring detailed technical knowledge. This typically involves intent parsing, protocol selection, transaction construction, and execution.

Related tools employ large language models to generate code or automation scripts tailored to specific crypto protocols and APIs, assisting users and developers in composing transactions, bots, or smart contracts with reduced friction.

Security Risks of AI Wallet Access and Agent-Based Execution

Giving access to AI agents to your data is not risk free. While the majority of the available assistants are known to be reputable software, even widely used platforms have been targeted by supply-chain attacks in the past. For instance, the well known platform Bittensor has been victim of “typosquatting”, meaning that malicious packages were released with names intentionally similar to legitimate libraries, so that users might mistakenly install them. These packages then execute malicious code, eventually resulting in emptied wallets and stolen funds.

For this reason, delegating access to your wallet to any software in order to execute transactions could be a potential doorway for malicious actors to attack your personal data and funds.

AI-Driven Market Prediction and Trading in Crypto

Another prominent category applies AI to market forecasting and trading strategy design.

Most approaches focus on price prediction, combining traditional time-series models with machine learning techniques. These models usually consume time-series data to find recurring patterns, which they use to predict the future behaviour of the time-series.Sentiment analysis, derived from social media, news, and governance discussions, is often used as an auxiliary signal. More advanced systems experiment with reinforcement learning agents trained on historical price data, though these models typically operate in simplified environments that abstract away protocol-level constraints.

Why General-Purpose AI Models Underperform in Crypto Markets

We believe that using general-purpose models, even if fine-tuned on relevant data, to perform sentiment analysis on social media and price prediction is a limiting approach. This kind of task could potentially be performed in a more optimized way by specialist agents capable of understanding each protocol’s nuances.

AI-Powered Lending and Yield Optimization in DeFi

AI is also applied to capital allocation and yield optimization within DeFi lending markets.

These systems compare lending platforms, liquidity pools, or vaults to identify allocations that maximize APY. In most cases, protocols are treated as interchangeable venues, with optimization driven primarily by advertised rates rather than by deeper modeling of protocol-specific risk, liquidity dynamics, or incentive mechanisms.

From the user side, automated yield aggregation is not a new concept. Protocols like Yearn, Morpho, or Gauntlet-optimized vaults already allocate capital across lending markets and liquidity venues programmatically, rebalancing based on rate differentials and utilization curves. These systems operate onchain, with transparent logic and battle-tested smart contract infrastructure.

The open question is whether AI-driven allocation offers a meaningful edge over what already exists. If the output is the same (capital routed to the highest-yielding venue with basic risk filtering) then the AI layer adds complexity without adding value. Users already have access to automated strategies that do this without requiring trust in opaque model outputs or off-chain inference pipelines.

More critically, it remains unclear whether end users would prefer AI-managed allocation over risk frameworks coordinated by human operators with domain expertise. In DeFi lending, yield is only one variable. Protocol governance risk, smart contract exposure, liquidity depth under stress, and incentive sustainability all matter. These are areas where experienced risk managers still outperform pattern-matching models trained on limited or non-representative data. Until AI systems demonstrate a verifiable, sustained advantage in risk-adjusted returns, the assumption that automation equals improvement does not hold.

Decentralized Infrastructure for AI: Compute, Governance, and Ownership

A separate class of projects focuses on building infrastructure for AI within crypto ecosystems, rather than end-user applications.

This includes decentralized or distributed computing networks designed to support AI model training and inference, as well as platforms that enable onchain hosting, governance, and ownership of AI models. Such systems introduce the concept of ownable or composable AI, where models themselves become crypto-native assets governed by smart contracts.

Examples of successful projects in this area are NEAR, Render Network and Qubic. While NEAR aims to build a blockchain built with AI agents in mind, the other two provide a platform that distributes incentives as rewards for training AI models.

While none of these projects innovate directly on the agentic or strategic side of the state of the art, as they do not, for instance, address how agents reason about protocols or make trading decisions, they provide real and increasingly important value to the broader AI ecosystem. By enabling decentralized access to computational resources, they reduce dependency on a small number of centralized cloud providers, lower barriers to entry for independent researchers and smaller teams, and introduce crypto-native primitives such as tokenized compute credits, onchain model registries, and governance over training pipelines. In doing so, they lay foundational infrastructure on top of which more sophisticated, protocol-aware AI systems could eventually be built.

Where we see value: protocol-aware learning

Many existing AI-driven trader agents in crypto are trained relying on generic abstractions of the market. Strategy design is typically based on price prediction, volatility modeling, or simple yield comparison, with little or no awareness of the internal mechanics of the protocols being used. As a result, these agents treat heterogeneous systems such as lending markets, automated market makers, and perpetual futures protocols, as interchangeable venues distinguished only by surface-level metrics like price, APY, or liquidity depth.

This abstraction ignores critical protocol-specific nuances, including funding rate mechanisms in perpetual markets, liquidation thresholds and interest rate curves in lending protocols, fee structures, incentive emissions, and governance-driven parameter updates. Consequently, agents trained under such assumptions often exhibit brittle behavior, underperform in live conditions, and fail to adapt to regime changes or stress scenarios.

Sandbox Environments for Protocol-Specific Agent Training

We believe there is significant value in a protocol-native training paradigm for AI agents, grounded in the idea of sandbox environments that faithfully replicate the logic and constraints of individual crypto protocols.

One possible approach is to construct protocol-specific sandbox environments that replicate core elements of a protocol’s smart contract logic, state transitions, fee models, and incentive mechanisms. This sandboxed environment can act as a controlled training ground in which agents can be trained using reinforcement learning or hybrid learning approaches. By interacting directly with protocol rules, rather than abstracted market signals, agents may learn strategies that are more closely aligned with the protocol’s underlying mechanics.

For example, in perpetual futures markets, an agent trained in a protocol-aware setting would be able to explicitly observe and reason about funding fee dynamics, margin requirements, and liquidation risks. In lending protocols, it would similarly reason about utilization-based interest rate curves, collateral factors, and liquidation penalties. This approach could allow agents to internalize causal relationships between actions and protocol-level outcomes, potentially resulting in more robust and interpretable strategies.

We believe that shifting from price-centric optimization to mechanism-aware learning could lead to agents that are better suited for real-world deployment, more resilient to changing market conditions, and more capable of identifying protocol-specific opportunities that tend to remain invisible to generic trading systems.

More broadly, we see this line of thinking as potentially aligned with a shift away from increasingly large, general-purpose models, and toward more specialized agents with narrower scopes, fewer parameters, and lower computational requirements.

Mixture of Experts Architectures for Multi-Protocol Reasoning

This approach could also lead to interesting directions when combined with Mixture of Experts (MoE) architectures.These models employ multiple smaller submodules, each specialized in a different part of the task, and have shown promising results across a range of domains (Mu & Lin, 2025).

Example of MoE basic architecture. A gating network is used to decide which expert should analyze the input data. The expert then is tasked to produce an output based on the input.

In the context of DeFi protocols, one could imagine training different experts on different protocols and subsequently integrating them into a single system capable of leveraging their specialized knowledge, for example by reasoning jointly about positions across a perpetual futures market and a lending platform.

As a potential side effect, such a shift could also lower the barriers to entry for training effective AI systems, making advanced agent-based approaches more accessible beyond a small number of well-capitalized organizations.

Lessons from Evolutionary AI: Self-Play, Open-Ended Learning, and DeFi Analogies

We see clear parallels with recent work in evolutionary and open-ended learning, suggesting that complex, tool-like behaviors can emerge when agents are trained in rich environments with minimal task-specific supervision. Rather than optimizing a fixed strategy, such systems often rely on population-level dynamics and environmental pressure to drive capability discovery.

Prior research on emergent tool use has shown that agents can autonomously discover and make use of environmental affordances, such as using external objects as tools, when doing so improves long-horizon reward, despite no explicit instruction to do so (Baker et al., 2019). Similarly, open-ended evolutionary systems such as POET show that co-evolving agents and environments can produce increasingly complex behaviors through continual adaptation, without a predefined notion of task difficulty (Wang et al., 2019).

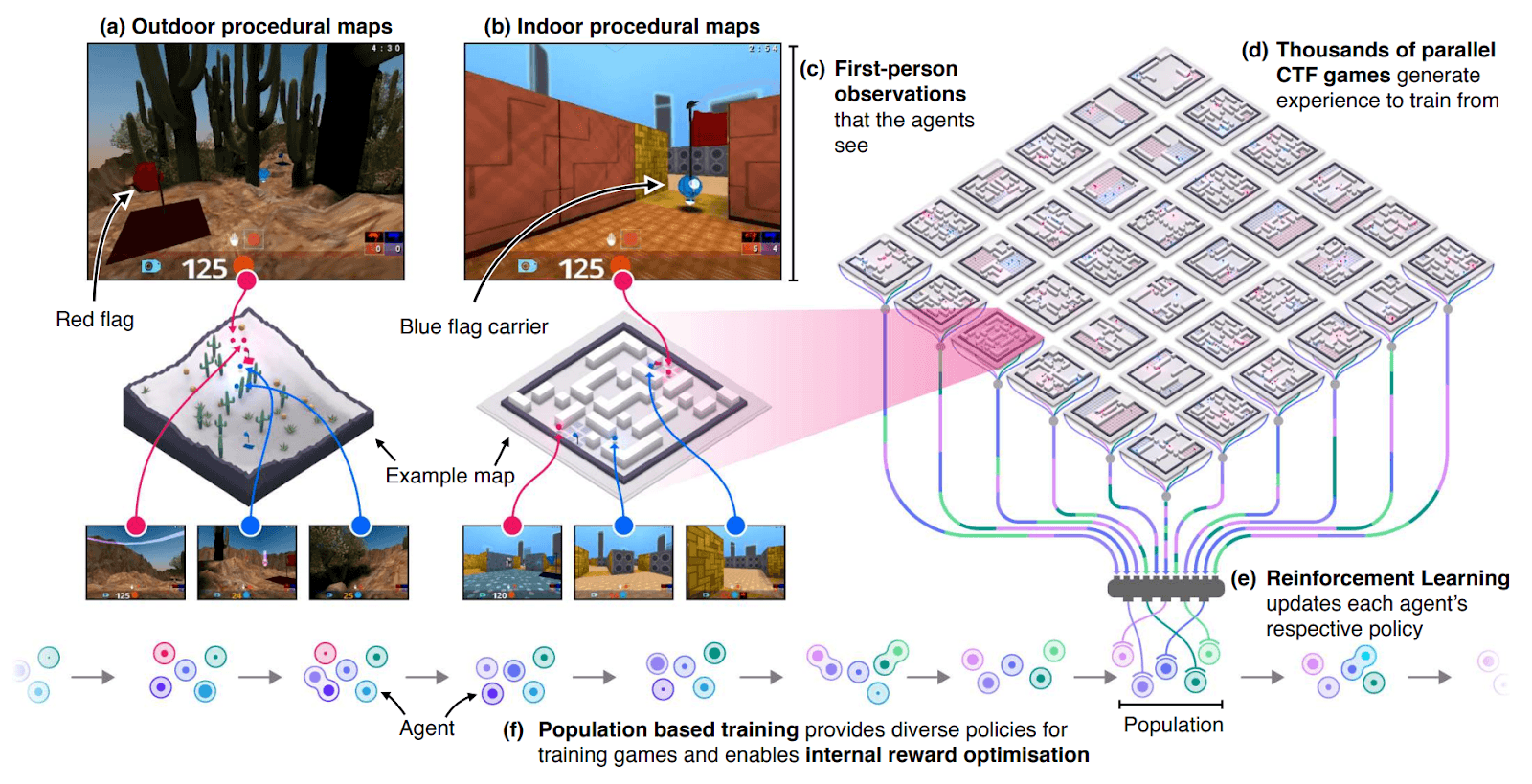

Example of visualization of the training process employed in (Jaderberg et al., 2019). The agents are put in procedurally generated maps and taught to play against each other. Image from (Jaderberg et al., 2019).

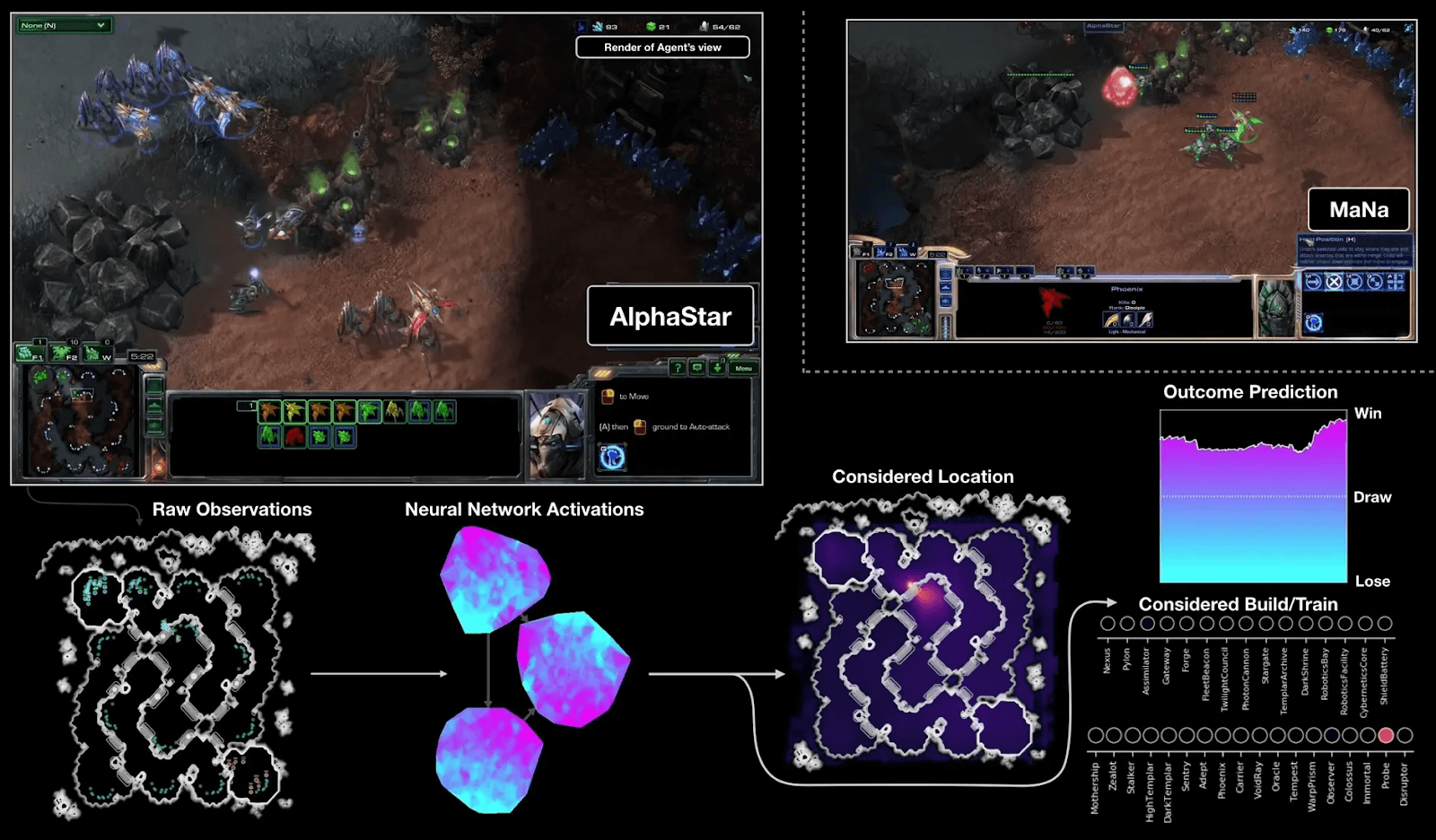

Prior work has demonstrated that iteratively matching agents against one another in multiplayer environments, across diverse and procedurally generated scenarios, has proven to be an effective paradigm for training highly capable agents. Through self-play and population-based training, agents are exposed to continually adapting opponents and strategies, leading to the emergence of robust, high-level behaviors that in some cases surpass human performance (Vinyals et al., 2019; Jaderberg et al., 2019).

Image taken from a demonstrative video of AlphaStar. The model learns the optimal way to play the game through self-play, reaching pro-player levels of ability.

An interesting analogy can be drawn between these environments and crypto protocols. A DeFi protocol constitutes a rule-based, interactive system whose economic mechanisms, fees, incentives, liquidations, and governance updates, form latent affordances that can be discovered through interaction. By framing protocol-native sandboxes as evolving ecosystems rather than static environments, such settings could allow agents to uncover non-obvious, protocol-specific strategies that are difficult to specify a priori.

This perspective suggests that population based and evolutionary training regimes could serve as complement to standard reinforcement learning approaches. These methods usually increase the model’s robustness and diversity, as well as high-level behaviours.

Evolutionary strategies facilitate the model’s exploration of the strategy space, helping the reinforcement learning approach to converge to a more robust and general strategy.

References

Mu, S., & Lin, S. (2025). A Comprehensive Survey of Mixture-of-Experts: Algorithms, Theory, and Applications. arXiv:2503.07137.

Baker, B., Kanitscheider, I., Markov, T., Wu, Y., Powell, G., McGrew, B., & Mordatch, I. (2019). Emergent Tool Use from Multi-Agent Autocurricula. OpenAI.

Wang, R., Lehman, J., Clune, J., & Stanley, K. O. (2019). Paired Open-Ended Trailblazer (POET): Endlessly Generating Increasingly Complex and Diverse Learning Environments and Their Solutions. arXiv:1901.01753.

Vinyals, O. et al. (2019). Grandmaster level in StarCraft II using multi-agent reinforcement learning. Nature.

Jaderberg, M. et al. (2018). Human-level performance in first-person multiplayer games with population-based deep reinforcement learning. arXiv:1807.01281.

Subscribe to our newsletter

By submitting you email, you confirm that you accept our Privacy Policy

Subscribe to our newsletter

By submitting you email, you confirm that you accept our Privacy Policy

Subscribe to our newsletter

By submitting you email, you confirm that you accept our Privacy Policy

Latest articles

AI x Crypto

Feb 6, 2026

AI x Crypto: The Case for Protocol-Specific Intelligence

AI x Crypto

Feb 6, 2026

AI x Crypto: The Case for Protocol-Specific Intelligence

AI x Crypto

Feb 6, 2026

AI x Crypto: The Case for Protocol-Specific Intelligence

DeFi

Feb 5, 2026

Gas Optimization in DeFi: Tools, Techniques, and Lessons from Onchain Perps

DeFi

Feb 5, 2026

Gas Optimization in DeFi: Tools, Techniques, and Lessons from Onchain Perps

DeFi

Feb 5, 2026

Gas Optimization in DeFi: Tools, Techniques, and Lessons from Onchain Perps

Updates

Feb 4, 2026

Riva Labs: a research-first approach to crypto technology

Updates

Feb 4, 2026

Riva Labs: a research-first approach to crypto technology

Updates

Feb 4, 2026